The FinTech Panorama

FinTech is a portmanteau of Finance and Technology. It is a new-age term that, at its core, is a technology aimed at improving and automating the delivery and use of financial services. FinTech leverages advanced software and algorithms to assist corporations, business owners, and consumers in better managing their financial operations and processes.

Traditional Finance involves walking into a brick & mortar bank branch and opening an account, taking a loan or overdraft, and depositing or withdrawing money. Traditional Finance, although credible, had a bevy of drawbacks. It was a slow and time-consuming process, i.e., there was an extensive list of steps that needed to be completed before a transaction took place.

There was an urgent need to improve these financial activities to overcome these flaws. As Albert Einstein said, “Necessity is the mother of all invention.” This necessity to significantly revamp the way financial systems worked led to the advent of FinTech.

Banks and Financial Institutions have long tried to streamline their business process by utilizing technology. The earliest signs of these institutions leveraging technology were Automated Teller Machines (ATMs). From there on, FinTech has grown by leaps and bounds.

FinTech is no longer seen as ‘a tool’ for banking corporations to provide an added facility to their customers. Instead, FinTech companies have enabled increased accessibility for their users through mobile applications. Disrupted the Traditional Finance system by innovating the processes. Innovations like Buy-Now-Pay-Later (BNPL) have taken the Financial System and turned it around on its head. FinTech has gone from being a ‘cog in the wheel‘ to the entire ‘wheel‘ itself.

The Surge of FinTech companies around the Globe:

Fintech provides a far more personalized and enhanced user experience and other benefits, including better technology and functional efficiency. This has led a good proportion of the globe to adopt FinTech over Traditional Finance.

The last few years had witnessed a fast acceleration in FinTech adoption, with adoption doubling every two years before the pandemic struck. When the world was shut down due to the pandemic, FinTech became an imperative commodity for all companies to stay afloat in these chaotic times. Advanced technology and want for economic market fluidity enabled the swift migration to FinTech alternatives. Even the most skeptical organizations have been compelled to adopt it. While 2020 and 2021 were the years of FinTech adoption, 2022 will be the years of innovation and transformation.

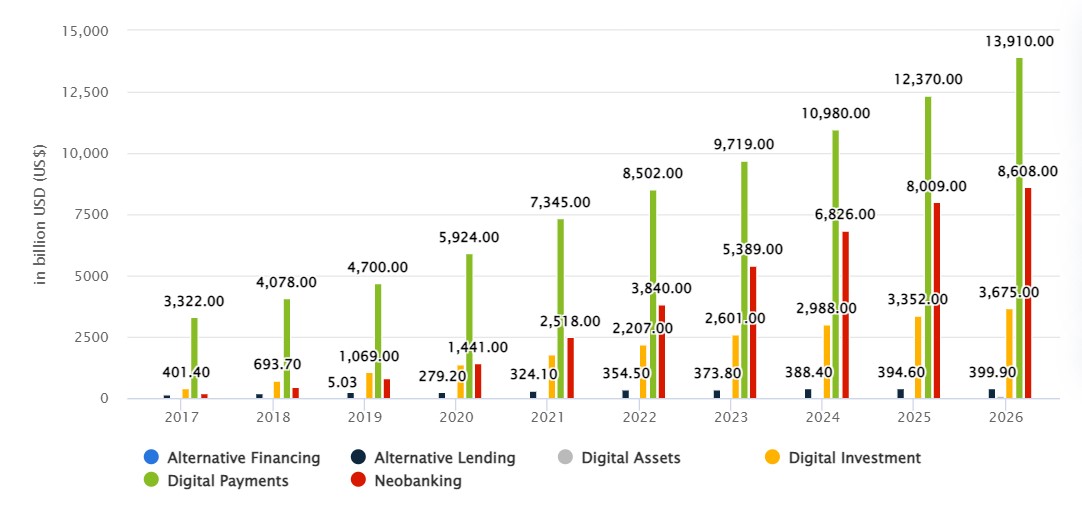

FinTech has been adopted far and wide since 2015. The years 2015 to 2019 witnessed an exponential growth in FinTech adoption from 16% to 64%. The pandemic alternatively pushed it further, leading the Global FinTech Market to peak at USD 7301.78 billion in 2020. The year 2021 saw an upward thrust in investments in FinTech solutions, supportive authorities, insurance policies and regulations, a developing reputation of digital payments, and greater collaborations between banks and FinTechs, which led to the unprecedented boom of the sector. By 2026, the Global Fintech Market is expected to reach $31,503.54 Bn. The United Kingdom and India have been the two most talked-about nations when FinTechs are discussed.

The estimates of Global Fintech Adoption (Source: Statista)

Head-to-Head: India vs. the UK

- On the FinTech Country Ranking List, the United Kingdom (UK) holds the second spot, while India has the 15th spot.

- In the Top 20 Global FinTech Hubs List, London – the UK’s capital city, was seeded second. India was represented by Mumbai and New Delhi, which were seeded 10th and 16th, respectively.

- The UK holds 2nd position, and India closes in on it closely with a 3rd position on the Fastest Emerging FinTech Ecosystem among countries worldwide.

- While London emerges as the only UK-based city to feature on the Top 50 Regional (Europe) FinTech Cities List, it bags the second spot. We notice something unique about India in its regional FinTech Cities List. The FinTech Industry is decentralized across five main cities: Mumbai, Bangalore, New Delhi, Pune, and Chennai.

- This shows that London acts as the only epicenter for exponentially growing startups. In India, the divide across the five cities is relatively equal.

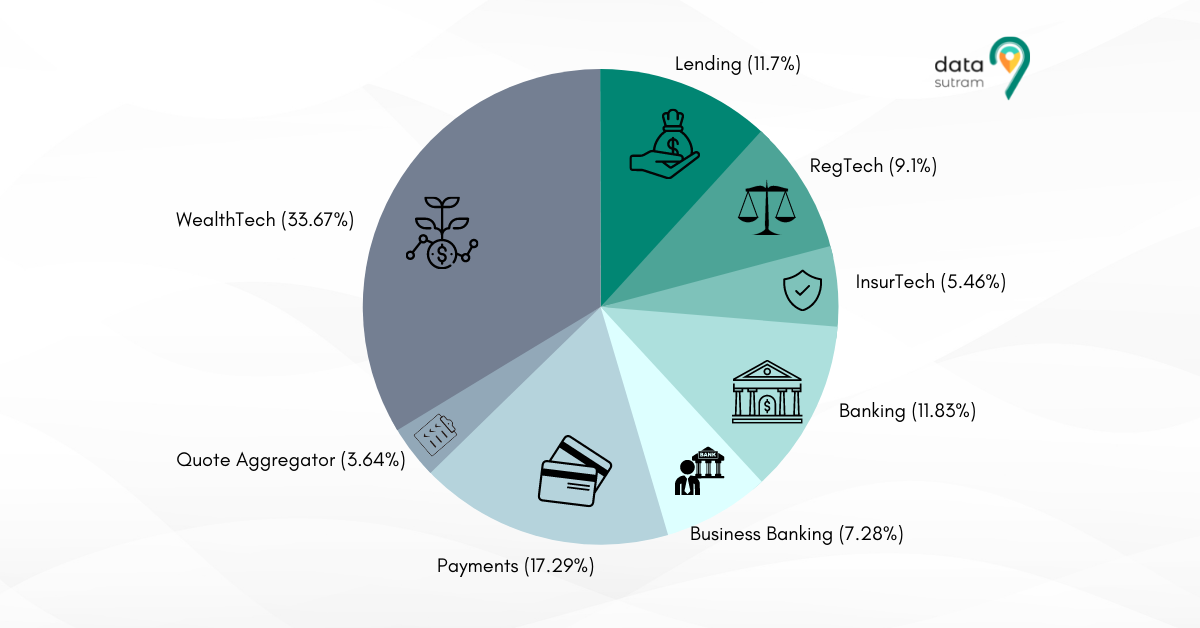

To contrast the two nations based on their FinTech landscapes, we consider the eight broad FinTech Categories. They are:

- Banking

- RegTech

- InsurTech

- Lending

- WealthTech

- Business Banking

- Quote Aggregators

- Payments

- Banking

It includes core banking products, including current personal accounts, savings, and mortgages. This category also includes banking platforms and operation FinTechs such as Railsbank and challenger banks such as Atom in the UK. In India, there are a bunch of incumbent banks as well as new disrupters. Banks like SBI and Kotak Mahindra have initiated their digital wings with services like YONO and Kotak 811. Neobanks like Jupiter, Niyo, and Open have also created a niche in the FinTech market. - RegTech

This FinTech category includes companies that are reimagining and streamlining risk (AML, KYC), credit scoring, and compliance software. Companies like Onfido and Quantexa in the UK provide SaaS, focus on identity and document verification, and cater to AML, and KYC needs. On the other hand, India still does not have an established RegTech company.

- InsurTech

InsurTech includes companies selling insurance digitally or introducing new business models or (re) insurance-specific software. They include personal and commercial insurance. InsurTech is an amalgamation of RegTech and FinTech in a new market context. Honcho, Cuvva, and Sprout.ai are a few of the successful InsurTech companies in the UK. In India, Policy Bazaar and Acko are the flag bearers of InsurTech disruption.

- Lending

Companies focused on innovating credit, from commercial to alternative and specialist lenders or platforms facilitating P2P. It also includes Consumer Lending. In India today, we see multiple lending models.

-

- Point of Sale transaction-based lending – e.g., BharatPe

- Bank Fintech partnership model – e.g., Indifi

- Marketplaces – e.g., PaisaBazaar

- Invoice discounting exchanges – e.g., KredX

- Captive models – e.g., Ola and Flipkart tie-ups with NBFCs and Banks

- P2P model – e.g., FairCentOn the other hand, Yobota, Banking Circle, and RateSetter are the top lending FinTechs in the UK.

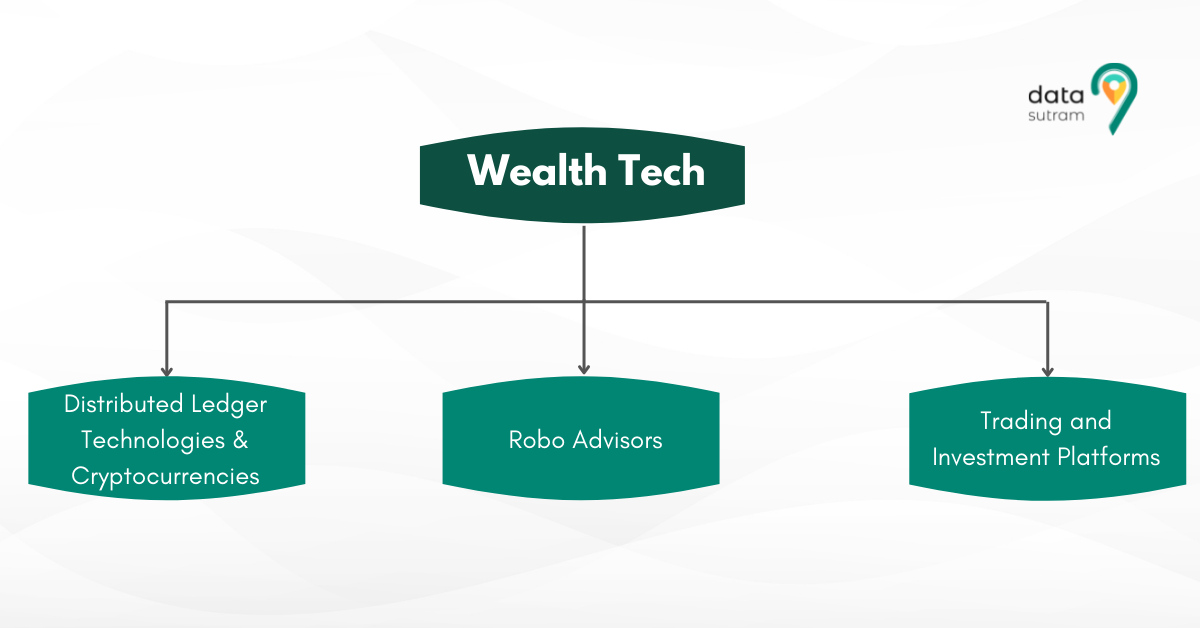

- WealthTech

When digitization met wealth management services, wealth tech was born. This category covers investment and management platforms, sales and trading analysis tools, personal finance management & crypto exchanges. It includes Personal Finance Management (PFM) and Investment Data and Information Services. Listed below are the top companies dominating the different sub-verticals under WealthTech.- Distributed Ledger Technologies & Cryptocurrencies

- UK – Nexo

- India – CoinSwitch and CoinDCX

- Robo Advisors

- UK – Money Box and Money Farm

- India –INDWealth

- Trading and Investment Platforms:

- Business Banking

This category is primarily focused on supporting SME businesses with their accounting, finances, payroll, invoice, and expense management needs,

- Quote Aggregators

Companies provide online comparison engines for consumer quotes, originally for insurance, but this has extended into broader financial services such as mortgages.

- UK – MoneySuperMarket

- India – PolicyBachat

- Payments

Businesses that provide underlying money transfer, remittance and foreign exchange services, from payments initiation to EPOS systems. Payments Initiation is performed by checkout.com, and EPOS systems are taken care of by SumUp.In India, PayTM, CRED, and RazorPay are the leading payments apps.

Visualizing the FinTech Sub Sector split in The UK

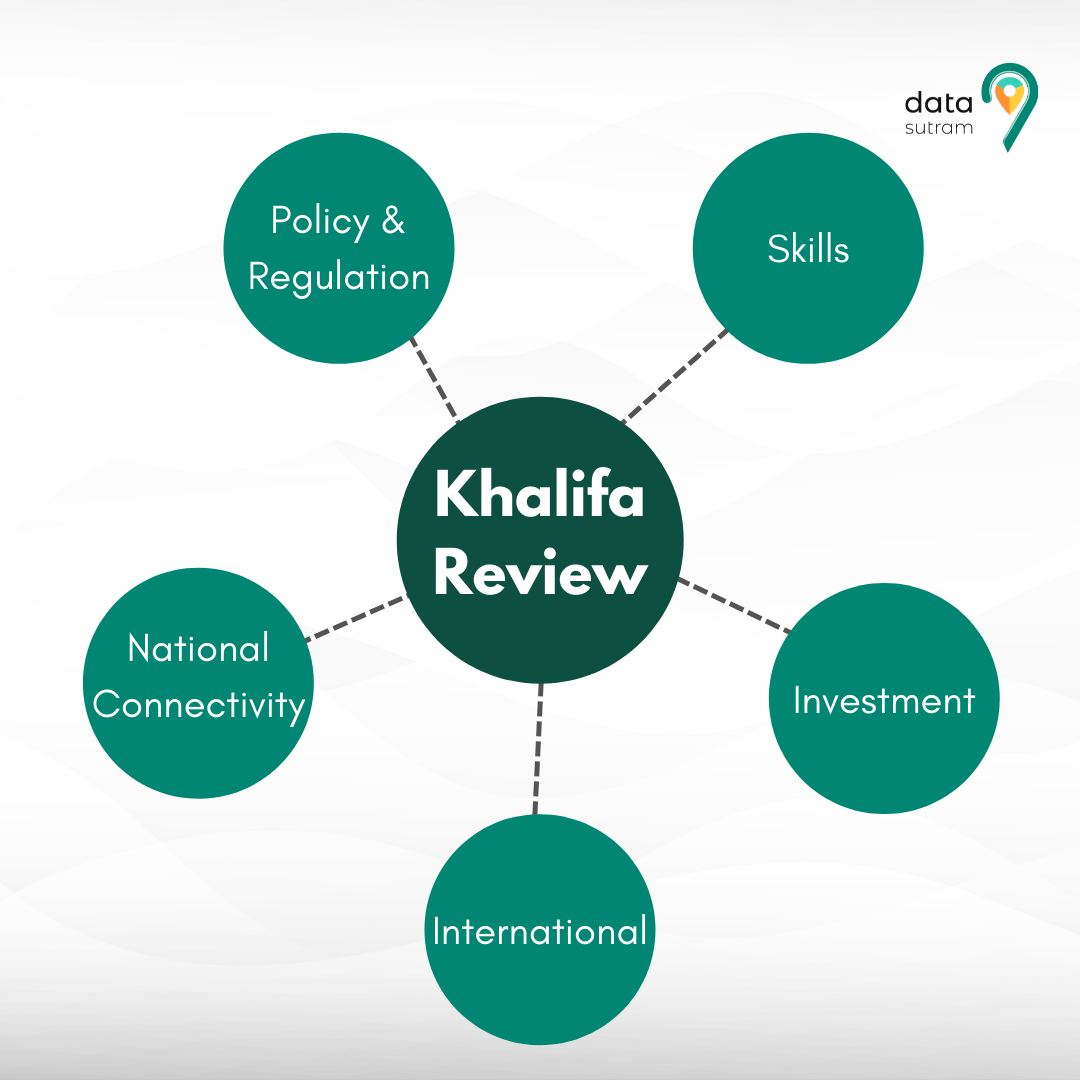

The Game-changer for UK: Khalifa Review

To remain at the pinnacle of the Global FinTech Performance Index, the UK Government asked Ron Khalifa to review and give suggestions for improvement of processes within the FinTech Sector of the UK.

The strategic review produced a five-point plan to help mitigate risks and take advantage of the opportunities in the global economy:

- Policy and regulation – dynamic leadership that protects consumers while also enabling and enabling fintech activity and competition.

- Skills – ensuring that fintech has an abundant amount of domestic and international talent, as well as the ability to train and upskill our current and future workforce.

- Investment – completing the funding ladder from startups to IPO

- International – a targeted approach to exports as well as inward investment

- National connectivity – leveraging fintech output all across the UK and facilitating connectivity among them.

Moving Forward: The Indian Context

Moving Forward: The Indian Context

In recent years, the growth of technology startups, in general, has seen an unprecedented surge, with FinTech being a key sector. India’s thriving FinTech industry is set to welcome a slew of new unicorns, unicorns, smaller startups, and traditional incumbents eager to collaborate on innovation. While each segment and stakeholder within the FinTech industry will take different paths, as we have discussed above, some takeaways and implications should apply to everyone:

- Experience, not product: Shifting mindsets from product-focused to consumer-focused will be critical.

- Rapid collaboration: Partnerships may hold the key to success in FinTech markets. To enable quick and easy collaboration with other market participants, stakeholders must invest in and develop technology (e.g., API) and policy rails (legal and business templates).

- Continuous innovation: Constant innovation must remain a priority not only to increase penetration but also to avoid being usurped by new players. Startups and incumbents can both initiate a consistent innovation process to stay ahead of the competition.

- Market velocity: With multiple the financial world’s numerous checks and balances, it is difficult to be dexterous and offer an evolving suite of products and services tailor made to consumer preference. This can be a critical differentiator in the FinTech market.

- Regulatory and government initiatives: The Indian FinTech story, particularly in payments, has been driven in a unique way by government initiatives such as UPI. Many other initiatives, such as AA and OCEN, are in the planning stages. They can provide critical stimuli for various stakeholders in the ecosystem to thrive. The pending data privacy bill will also be an important lever in allowing FinTech startups to onboard and use customer data.

The Indian FinTech ecosystem is unique because it is a playground for a variety of players. We have young FinTech startups leading the charge and traditional banks countering with improved digital offerings. We also have BigTech players entering the foray through payments and other products. There are also government and regulatory initiatives aplenty to help the ecosystem grow. It will be exciting to watch where the industry is headed and witness the outcome of each type of player.

Key Takeaways:

- Disruptive technologies such as artificial intelligence, blockchain, and alternative lending transform financial services.

- Incumbents recognize the benefits of running their processes on digital rails. As a result, most are either rolling out digital services of their own to directly compete with tech-savvy startups or acquiring and partnering with them to leverage their capabilities.

- The UK FinTech landscape is fast upgrading and adopting the Khalifa Review to unleash new possibilities in their respective sub sectors.

- The Indian FinTech is adapting to the global market velocity with continuous innovation and rapid collaboration with a variety of stakeholders.

Don’t miss out and be a part of the Fintech revolution, schedule a demo.