Why should MSMEs consider Digital Lending over Traditional Lending?

Can you vividly imagine walking inside a bank and waiting in a queue for getting things done? Once the queue ends, you ask the person what you want to get done and they redirect you to a different queue. Or worst; it’s lunchtime already. Sometimes you don’t carry the right documents and other times the passbook printing machine runs out of ink! Let’s face it, a trip to the bank is not pleasant many a times.

Thanks to technology, the younger generation has to face such situations a lot less. The urban crowd is catching up faster than the rural crowd. And from individuals to businesses to MSMEs the digital era is pulling out tricks from the bag for everyone.

The MSME Perspective

Consider the above situation and combine it with a merchant trying to secure a loan. Remember how Sharma Ji was securing a loan for the first time to turn his retail chain dream into reality? There are many other Sharma Jis, in fact, India is home to 63 million MSMEs and also home to dreaming big.

Such a situation where an MSME merchant has to tirelessly make rounds of the bank to fulfill his vision of expanding his store or establishing new stores can cost the merchant unnecessary trouble.

Technology, data, and alternative data on collaborating with lending give us a gift in the form of digital lending. Digital lending has the power to eliminate the above situation and enable MSMEs to access better credit opportunities.

What is the digital lending revolution?

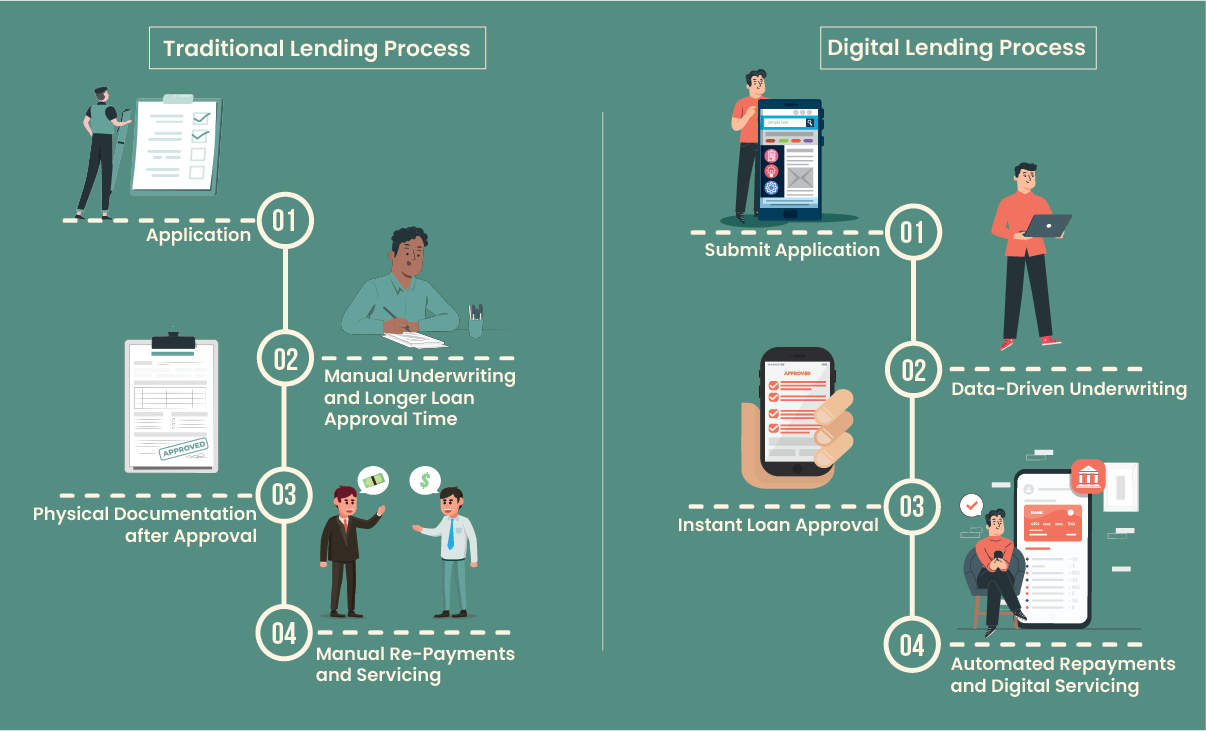

Digital lending is the process of lending that takes place through web platforms or mobile applications and involves the use of technology for credit valuation and authentication. By leveraging technology, banks, NBFCs, digital lending applications, etc., can more efficiently identify and reach their potential customers.

More and more people are choosing digital lending over traditional lending because of the benefits it provides to end customers. There are several types of digital lending and various financial institutions and fintechs are creating lending products that suit specific target audiences.

Whether or not you have your bank’s branch right around the corner, the internet has penetrated rural areas widely, hence you have digital lending available at your fingertips. The convenience that digital lending brings pushes people to choose the digital way.

Shortcomings of Traditional Lending

MSMEs are now becoming a part of the digital lending arena by introducing digital payment collection, digitization of trade records, and various government efforts that promote financial inclusion. The RBI is also taking steps to promote the digitization of the lending process.

The MSME sector contributes significantly to India’s employment and productivity and around 40% of credit allotment in this sector is through informal means. On the other hand, after COVID-19 affected our lives, many startups and fintechs raised to cater to the lending needs of MSMEs. They focused on providing credit to MSMEs who have previously been unbanked.

In the case of traditional loans, repayments have no relation to the performance of the business; they are fixed. This isn’t very flexible for MSMEs as even one month or one-quarter of a difficult business environment can cause stress of repayment. This makes digital lending options a more obvious choice for MSMEs as their potential can be tapped into by simply learning and adopting technology.

The Upside of Digital Lending

Digital lending has many benefits, especially for MSMEs, including:

- Flexibility & Accessibility – It gives a lot of flexibility and convenience as MSMEs don’t have to worry about visiting a bank and going through the hassle of getting a loan sanctioned. You can access digital lending applications or platforms with a few clicks on your mobile phone and get credit according to multiple factors related to your business.

- Saves Time – By streamlining the loan application process, MSMEs can access credit in a matter of few months or even weeks through various applications which otherwise would take very long.

- Cost Effective – Digital lending platforms typically have lower overhead costs than traditional banks, allowing them to offer loans at lower interest rates and with fewer fees.

- Increased Transparency – It also helps MSMEs gain visibility into their finances which in turn helps them manage their cash flow better and make informed financial decisions.

It’s a Win-Win for Lenders and MSMEs

In short, digital lending gives MSMEs access to fast, convenient, and cost-effective funding. Since MSMEs consist of a huge chunk of the working environment of the country, opting for digital ways can not only help MSMEs but also help lending institutions cater better to a large part of the population that holds growth potential.

More emphasis should be laid on educating MSMEs about what they can do if they join hands with lending institutions and also about the benefits that they will avail from it. This way, MSMEs can increase their visibility through digital lending, and a culture of formalization in the economy can be unlocked.

On the flip side, digital lending platforms and applications can utilize many ways to factor in the type and amount of loan that an MSME can avail of. Here, data can be fruitful and to go the extra mile, alternative data can help gain insights that will allow making better decisions. Today, various alternative data sources can help lenders analyze the health and potential of any MSME. Companies like Data Sutram offer insights on 6 million+ MSMEs on data parameters like Merchant Identity, Consumer Demographics, Transaction Data, etc.