Understanding Bharat — Decoding the DNA of Indian Merchants

Much Ado About Creditworthiness

Fearing the rise of Non-Performing Assets and default risks, Indian banks rely on the stringent structure of 5 C’s -Character, Cash Flow, Condition, Capital, and Collateral- before granting the loan to merchants.

While large enterprises might boast of a good credit score, India’s MSME sector, most of which lack collateral or past credit history, are posed with an infinite loop of credit rejection, as banks fear the high cost of small ticket size loans.

The Merchant DNA- An Essential Ingredient

The fintech sector aims at revolutionizing the SME lending space and decode the Merchant DNA with technology and a new vision.

Past credit history and CIBIL score are not the only determinants for granting loans.

Rely on alternative data from sales, invoices, GST returns.

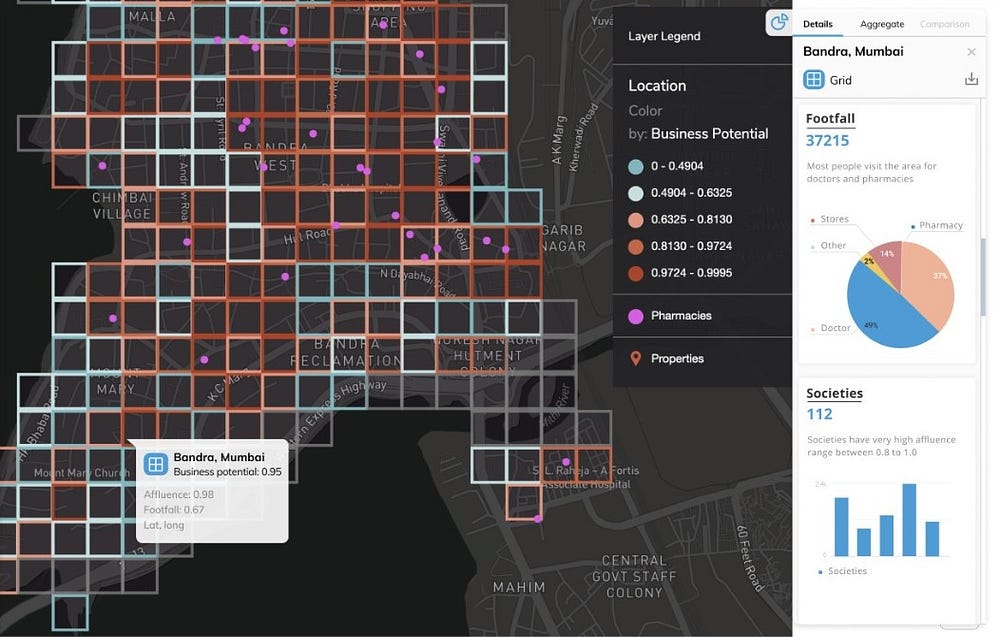

Spatial analysis of merchants geocodes loan data

Geocoding Merchant DNA

The data serves as the merchant DNA that fuels the SME lending space, digitization of lending platforms, and financial inclusion of the underbanked.

Merchant Acquisition

Visualize and scan the entire profile of merchants pan-India and generate quality leads using Location Intelligence-

- Merchant Name

- Merchant Address

- Customer Footfall

- Potential Score

Field Investigation

Technology is power. Technology is speed. GIS application unleashes the power of field investigation for the verification of merchants in a jiffy. A Confidence Score generated by a Location Intelligence platform ensures the veracity of the merchant. Bid adieu to the days when agents would have to physically verify the existence of merchants.

Location Profiling to Mitigate Risks

Once the on-ground sales team has full access to the merchant database, geospatial Trade Area analysis cites powerful observations about creditworthiness and delinquency that assigns merchant score based on

· Business potential

· Expansion opportunities

· Affluence

· Market trends

· Customer footfall and Economic Activity

· Competition

Young India- The Path Ahead

The merchant DNA speaks volumes about the underlying crisis, credit gap, and potential of young India, that traditional risk modeling fails to capture. It is the need of the hour to finance the credit gap and scale up infrastructure for low-cost SME funding. The grassroots level analysis of micro-merchants will reveal the economic picture of India and lead to the adoption of schemes that would enhance their position. It is when the local grocer or a retail vendor crosses the eligibility threshold for formal credit, that we can claim to have understood the essence of Bharat, and lead the way forward towards a holistic economic development.