How can banks take their fraud prevention game to the next level?

Every day, all of us keep evolving in one way or the other. We keep up with technological trends to upskill ourselves, we keep up with fashion trends to look our best, and we keep up with social media trends too.

In the same way, we are constantly striving to keep our privacy and security systems updated to avoid falling prey to fraud. But with every technological update, fraudsters keep getting creative with their strategies.

Fraud has been a big issue in the banking industry as well. Traditionally, fraud was considered the cost of doing business in the banking industry. With the number of cases going up daily and banks losing billions of dollars every year, various security measures are being implemented.

What is Banking Fraud?

Bank fraud is a type of financial crime that involves misusing a financial institution or its services for personal gain. In simple terms, it is a situation in which any individual or individuals tricks or cheats on a bank to steal money or gain illegal benefits.

Fraud has been prevalent for a long time in the banking industry and is a significant issue that banks are trying to tackle. In the financial year 2022-23, RBI reported 13,530 cases of fraud, involving an amount of Rs. 30,252 crores!

Consider this scenario; 5 individuals establish a company called Lifestyle Interiors. They then approach the residents of a village in Rajasthan, India, and claim that if they open an account with Motak Bank, they will receive a loan. Since the villagers need money, they agree with them and open a bank account.

But these individuals have evil intentions. They show that the villagers are the employees of the fake company they’ve established and deposit money into their accounts every month to avail of a credit card.

Soon, 72% of the employees i.e. villagers receive a credit card, and the fraudsters max out the limit and run away. After defaulting payment for several months, bank representatives reach the village and they understand the whole situation. This is one of the ways people commit fraud. In this situation, the fraudsters exploited the bank’s services and the villagers’ trust for personal gain which resulted in financial losses for the bank. But how could the bank have avoided falling prey to such a fraud?

The Growing Concern

Although banks have their fraud detection and prevention measures in place, fraudsters have been outsmarting the banks for years. Recent statistics and trends suggest that fraud has become a crucial problem for the bank to be tackled with.

According to RBI’s 2022-23 Report, banks witnessed the maximum number of frauds in the digital payments category. Out of the total fraud cases reported, 49% or 6,659 cases belonged to the digital payment – card/internet category.

It is also interesting to note that the maximum number of frauds was reported by private banks but the amount involved in fraud was higher in public sector banks. An analysis of the vintage of frauds reported during FY 2021-22 and FY 2022-23 displays that there is a significant time lag between the date of occurrence and the date of fraud detection.

These statistics indicate that the banking industry can make adjustments and certainly adopt new technologies like AI, fraud detection models, etc. to detect frauds more efficiently and prevent any losses.

DS Authenticate to the Rescue

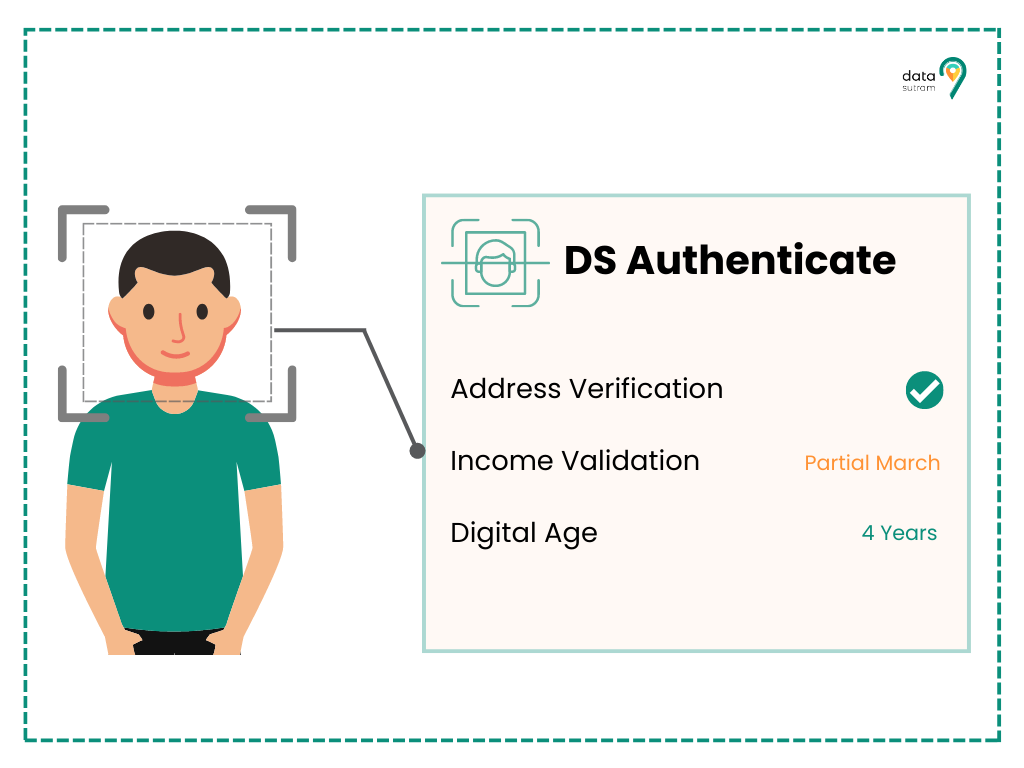

Data Sutram has created an innovative solution that aids banks in identifying fraudulent customers. With the help of DS Authenticate, banks can take their regular KYCs and other fraud check methods one step further.

In today’s time when customers are being acquired through a complete digital journey, it becomes difficult to gain confidence in an individual’s identity. By leveraging DS Authenticate, banks can go beyond traditional KYC and fraud checks by utilizing additional data sources.

Using inputs like name, phone number, email id, etc. DS Authenticate will tell you more about the customer like their phone number vintage, digital footprint, and more attributes to give you a sense of the risk associated with that person.

In short, DS Authenticate uses the declared details of an individual and derives vital information through alternate data sources to calculate the level of risk and identity confidence of an individual.

Interested to know how you can leverage the power of DS Authenticate? Book a demo with team Data Sutram!